This question emerged from the milieu of my cognitive stew whilst in the shower. The knee-jerk part of my brain, the fast-thinking portion that doesn’t like to dwell spat out a “yes” and moved on. The more ponderous parts of my cerebrum latched onto the question, and I’ve been mulling it over ever since.

Diverse Investments

I would hazard that most readers are well-versed in the benefits of taking a diversified investment approach, the ‘only free lunch in investing’. At its core it’s whatever the opposite of having all your eggs in one basket is. Your future omelettes are spread between a multitude of wicker storage vehicles – if one of them is dropped you won’t end up with the contents all over your face.

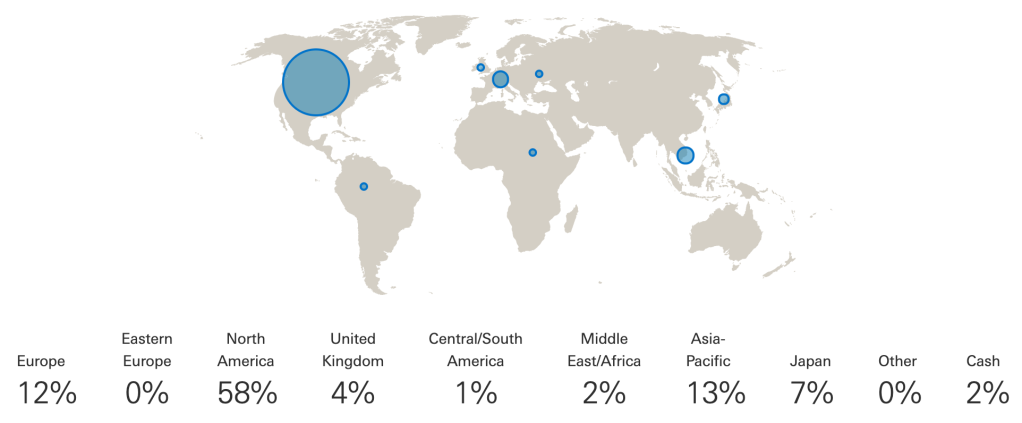

From a geographical standpoint, I’m fairly well spread. A benefit derived from using a true global index tracker fund for the majority of my equity investments. When my total wealth is taken under consideration I’m perhaps a bit under-staked in ‘Muricah. Equally I’m probably carrying a bit more UK exposure through other cash holdings. Neither one a perilous situation to be in.

What about asset class diversification? You can find all sorts of funky portfolios online, that have spreads right through different asset classes. The overwhelming majority of my invested wealth is (shock horror) in equities. One could argue that I’m under-invested in equities – I know others are all-in on this asset class. The 100-age rule of thumb is much too conservative for my own appetite and a selection of my blogging peers approximated a 105-age rule.

My asset class diversity will remain low for the foreseeable future. Select equities, bonds, cash, commodities or cryptocurrencies could take the form of ‘satellite’ holdings at some point, but not at this juncture. Other sexier riskier asset classes are less likely to feature. For example, P2P remains in my bad books – its risk-reward balance is tipped the wrong way for my liking and I’m staying clear.

Diverse Income

Multiple income streams are beneficial for similar reasons as having diverse investments is. I happen to be in one of the most secure professions there is. It’s been around for thousands of years. It’s universally necessary, especially so at the moment. My skills translate across countries and cultures. The security is a blessing for sure; I’ve been fortunate enough to not have given my income stream a second thought throughout the Covid-19 pandemic.

This is only partially reassuring though, as I’m reliant on this one role for 100% of my income. If I was stopped from being able to practice medicine tomorrow, it would cut my cash flow to £0. That, to me, seems like a stark vulnerability. A gaping hole in my financial Death Star that a pesky X-wing could proton torpedo at any moment. Admittedly such an occurrence is unlikely, but even if the chance of lightning striking is rare it doesn’t mean we should waltz outside with a brolly in a rainstorm.

Medical professionals are highly sought after, highly employable. For the time being. Mr. Bucket can attest to the unemployability created by the rise of the machine. Although medical practitioners are the group least at risk, the ONS still puts 18% of jobs at risk of automation. I rate the likelihood of my professional career being cut short by robotic intervention as ‘exceedingly low’, but definitely not ‘zero’.

What if there are significant changes in the way healthcare is delivered in the UK, which makes me less or un-employable? What if, in the future, I don’t want to be a doctor anymore? Overall I think my income diversity is poor. Definitely food for thought.

Diverse Retirement Funding

A lone strategy for retirement finances leaves one open to a single, critical, financial blow. For example, a box full of cash is an asinine choice for retirement funds as it’ll be decimated by inflation, moths, mould, floods, fire and the light-fingered. Those outwith FI circles are presumably relying on their workplace pensions ± state pension as their source of income in retirement. If the plan is FIRE, a more layered approach is usually required.

The NHS Pension remains a strong choice for the retirement finances of the NHS professional. I’ve made no secret, however, of my concerns about its future guise. Why should I be all-in on the NHS Pension? Why lay all my money on it and then bite my nails to the quick hoping it doesn’t succumb to some meddling politicos in the future? No, it makes no sense to strive for income and investment diversity only to bet it all on a single horse.

My (early) retirement finance plan is by no means unique, complex or even that exciting. The usual four horseman appear – the NHS Pension, a SIPP, a LISA and a stocks & shares ISA. They provide temporal flexibility by being accessible at different ages. They provide resilience against extraneous interference – it would take sweeping changes in financial policy to bring them all to their knees. They provide diversity in how they grow – the NHS Pension’s accrual/revaluation vs. the different funds in the others. The others protect me from the actuarial reductions for taking the NHS Pension early. The NHS Pension protects me from the whims of the stock markets. Oh and there’s potentially the state pension donkey braying somewhere too.

I think that this is about as robust as I can make my retirement plans for the moment. It certainly feels a much stronger set up when I compare it to my singular income stream.

“Too much diversification can dilute what you’re trying to do by distracting you from the true purpose of your money which is to grow in as low-cost and low-tax environment as possible so as to meet your goals.” Pete Matthews of Meaningful Money.

Diverse Interests

There have been a handful of retirement U-turns in the FIRE community recently. The factors driving these about-faces is a story for another time. I’ve been thinking about how to avoid a similar fate. Not that returning to work post-FIRE is wrong, a failure, hypocritical or really negative at all. If that’s what I end up doing too then so be it. I’m simply keen to be intentional about my plans.

I’m fortunate that medicine is a diverse career. It’s possible that I can keep things fresh and engaging by following different branches as time marches on. It might be that a tapered working schedule helps me ease into retirement, or more of a FIWO approach than FIRE. Or a transition from clinical to non-clinical work. There are options for sure.

Do I have enough other interests to keep myself occupied? I think so. I won’t regale you with a full list of my other interests and hobbies. A recent ten day period stuck indoors yielded a small degree of ennui, though I was hamstrung by not being able to engage in any outdoor activity, see friends etc.

I can always learn new tricks too. If you’d have told the Mr. MedFI of five years ago that he’d be blogging, about personal finance no less, he’d probably have laughed out loud at the surreality of the idea. I don’t predict issues with a post-FIRE lifestyle, but I guess who ever does?

Verdict

Am I diversified enough? Not quite. I’m content with a diversely invested portfolio and a retirement plan that’s set on multiple pillars. There’s vulnerability though in a total reliance on one source of income. Overall I give myself a solid B. Not too shabby, but definitely room for improvement. For that, I’ll have to engage that slow-thinking brain a little bit more. In the meantime, are you diversified enough?

TTFN,

Mr. MedFI

I think I’m in a similar position to you, Mr MedFI. My equities are well-diversified, but my overall assets are probably not – pretty much all cash or equities! And my income is entirely dependent on my job. I think I’m young enough where that’s not necessarily a problem, but it’s still food for thought for the future.

LikeLike

I think that deriving income from a sole source is grand, but I do prefer a layered, backed-up approach in many other walks of life. Why not income too? It’s difficult though; a medic’s world leaves room for little else.

LikeLike